Strive for that happy medium between taking on too much risk and taking on too little.

FROM BARRON'S | MAY 31, 2016

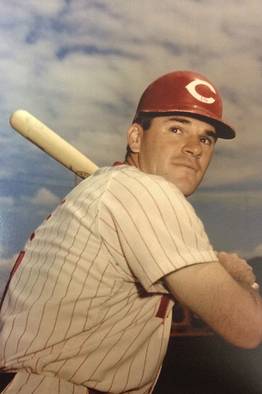

It is a time-honored tradition in the world of investing to use sports clichés. Yes, it’s a cop out, a failure of collective imagination, but rather than fight it just now, we are going to jump on that bandwagon. And not just sports clichés; we’re going to embrace all clichés—after all, most clichés have a real kernel of truth. To wit, in this market, it is emphatically time not to swing for the fences, not to be a hero, not to go for the gold. It is a time, in short, to hit singles.

Singles are the most unglamorous of hits—no one gets awarded the singles crown at the end of the baseball season. And there are no famed money managers and investors who proudly tout their ability to generate rather modest returns consistently. We laud the outsized personalities and their gaudy results, and then gleefully lambaste them when they falter. Recall that Babe Ruth led the baseball world in both home runs and strikeouts.

Today’s financial landscape, however, is decidedly single-friendly. It is a low-rate, low-return, low-yield, and low-volatility world. Yes, there are, and absolutely will be, periods of intense volatility, as we saw in equities at the beginning of this year through February. But volatility, however you measure it, has been very low this past year in the aggregate. Except for a few brief spikes last year and the beginning of this year, the VIX (a common gauge and a trading vehicle to boot) has stayed consistently under 20 (which is quite low), while equities, as measured by the S&P 500, have not hit a new high in the past 12 months.

What’s an investor to do?

As we said a few months ago, these markets present a few choices, none of which seem immediately attractive. Investors can take the relative placidity of the current financial world as an opportunity to make selective bets on areas that might generate spectacular returns. As we have seen with a fair number of spectacular hedge fund blow-ups, however, the penalty of being wrong seems to outweigh any current benefits of being right. Some of the luminaries of the hedge fund world, such as Daniel Loeb, Bill Ackman, and Kyle Bass, have seen some of their largest holdings lose staggering amounts of money. They may not be representative of investors overall, but they provide an example of what can happen in the reach for yield and return.

Another option is to be very conservative. That might entail substantial concentration in A-rated bonds and government securities. The problem there is that in a very low-yield environment, any small rise in short-term rates can spark substantial price declines in longer-dated bonds. (The U.S. 10-Year Treasury Note has been mired stubbornly below 2%, as the Federal Reserve has embarked on a course of gradual tightening, and other sovereign bonds’ yields, such as Germany and Japan, are even lower). While price declines of U.S. Treasuries, for example, will not affect the amount of income they generate, their paper loses maintained over many years undoubtedly will be unacceptable to many investors, who then will sell at a loss.

Yet another tempting alternative is to move assets into passive vehicles. Clearly, this is where investors have put their money this year and last, as active funds (of equities especially) are sustaining negative flows, while ETFs and index funds garner the bulk of new money (almost $400 billion in 2015, according to Morningstar) . But even though passive funds in general have advantages, they do not have advantages in all categories all of the time. Not all asset classes are well represented by an index, especially emerging markets. And active funds can do particularly well in categories in which deep analysis and fundamentals are rewarded, such as small cap stocks.

Too conservative and too risky are the Scylla and Charybdis of static markets. Or to use another cliché, they are the ‘too cold’ and the ‘too hot’ porridge of Goldilocks fame. Both of these temptations in churning, nowhere markets will likely lead investors astray. Yes, it’s always possible that swinging for the fences will work, and may be a strategy to generate spectacular home run returns. It is also possible that all investment grade and sovereign bonds and all passive vehicles will shelter assets just as that next storm hits.

But it is more likely that excessively aggressive or defensive behavior, triggered by static, low-return markets, will underperform or rack up even worse results. A low-yield, low-rate, low-return world—albeit one marked by periods of volatility—is the ideal environment for a measured approach to investing that takes some select risks as part of an overall strategy spread across multiple categories. That may not be sexy or startlingly original. It is hitting singles, and it is always surprising how hard it can be to maintain that discipline in a noisy, churning time.

It first requires resetting expectations. Rather than setting the bogey at 8% more or less (which is where many pension funds and institutional investors still are), expectations for equities and bonds need to come down. Resetting expectations does not mean that exceeding 3%–5% returns is no longer feasible, or that the multi-year run in equities or bonds is at end. But it does mean not chasing higher returns with ever-higher risk in crowded and/or illiquid trades, and not dismissing investments with a more modest valuation and return profile that assumes strong underlying fundamentals.

The result is positioning that is grounded in solid fundamentals and selecting investments (or managers) with a leavening of risk. If markets meander, investors have a decent chance of generating modest returns. If markets implode, they will suffer less. And the kicker is that if equities suddenly take off (a possibility after a stagnant year) or bond yields fall further (also a possibility in a world of negative interest rates), then portfolios will harvest a considerable amount of the upside. Investors who buy the stock of a high-quality tech company at a reasonable valuation that pays a 2% dividend, and expect only modest price appreciation, are more likely, if the market rises 10%, to enjoy a pleasant ride, with less exposure to volatility or downside.Of course, even when embracing singles and clichés, there is no free lunch. There’s no such thing as “risk free.” Even a strategy of going for singles can lead to pop ups, strikeouts, and errors. But in this climate, it’s the wisest approach, and one that may—one last parting cliché with a mixed metaphor thrown in for good measure—punch well above its weight.